Belleville property taxes: myth versus reality

By Mark Hodgins

BELLEVILLE – There seems to be a perception in Belleville that property taxes are far higher than in most other communities in Ontario, but that doesn’t appear to be the case.

In the weeks leading up to the municipal election, QNet News heard concerns about property-tax rates from many residents. More than a few people wanted answers from candidates as to why people here pay so much compared to other cities.

QNet News decided to look into whether tax rates really are higher in Belleville.

Residential and commercial property taxes are dependent on assessments of property values done by Ontario’s Municipal Property Assessment Corporation. Every year, municipalities determine the amount they need to charge in taxes to pay for local services and projects.

Taking into account the total value of property assessed by MPAC, they then set a mill rate to calculate every property owner’s total tax bill. The mill rate multiplied by the assessed value of the property is the amount of the tax bill.

Susan Howard, Belleville’s revenue and taxation manager, says the city is pretty much average when it comes to property taxes. The perception that our rates are far higher can come from people moving here from larger municipalities, she said.

“If you move from Toronto, our taxes probably could be higher (thank Toronto’s), but (Toronto has) a different assessment base,” says Howard. “The same house here is probably going to be (valued at) three times as much” in Toronto.

Toronto has a massive assessment base, with more residential, multi-residential, commercial and industrial properties than most cities. Much of the city’s tax revenue comes from industrial and commercial properties, simply because there is such a huge number of them.

Imagine a pie. A property-tax pie.

In Toronto, the portion of the pie filled by residential properties is smaller when compared to that filled by commercial, industrial and other properties.

In Belleville, 53 per cent of that pie is filled by residential properties.

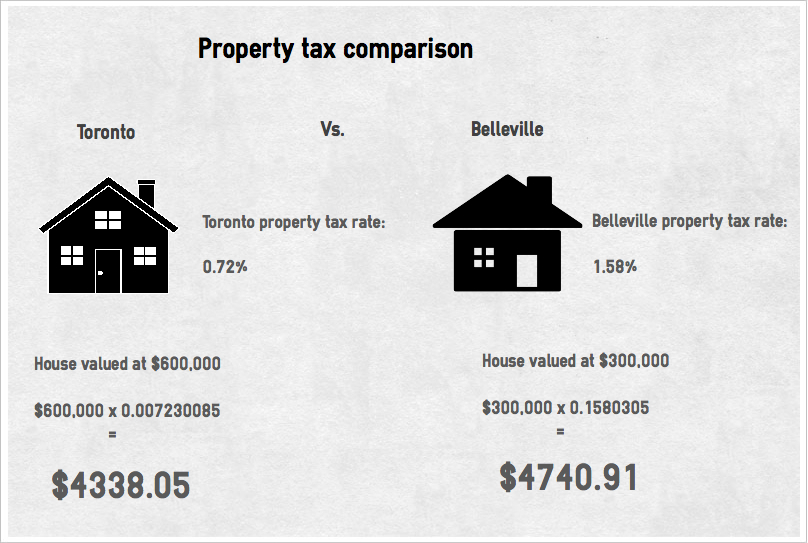

Because of this, our residential base has to pay more in property taxes. However, property in Toronto is valued far higher:

So a Belleville property-owner with a house valued at half the amount of one in Toronto ends up paying more in taxes than the Toronto owner does.

But what about communities more like Belleville? How does our mill rate stack up against them? Some comparable ones:

So Belleville’s tax rate is higher than that in some places, but does not look to be out of line for this part of Ontario.

A portion of property taxes isn’t decided by the municipality: the charge for education. That’s determined by the province and is uniform for all of Ontario. The education tax dropped from $2.12 per $1,000 of assessed property value last year to $2.03 this year.

One local taxpayer, Chris Fry of the Benton Fry Ford dealership in Belleville, has lived in the urban part of the city and now resides in the rural area, the former Thurlow Township. He’s seen first-hand how taxes differ by area: he now pays around the same property tax as he did on a property half the size in the city. Fry said he is less concerned about the cost than where the money goes.

“Do I pay too much? I feel like I don’t,” said Fry. “But do we spend the money wisely? I would say that’s an area we could work on.”

Whether the money is spent wisely is a question many people might have. There’s a wonderful tool called a property tax calculator on the City of Belleville’s website that helps to give an idea of where your property-tax money goes. After you enter the assessed valued of your property, the calculator determines what the taxes are. It also asks if the property is located in urban or rural Belleville, and can show you what the money is spent on.

For every $1,000 of assessed residential property value the urban property tax in Belleville is $15.80. Here’s a breakdown of how that property tax is divvied out:

The remaining $8.40 is the “core” rate. That covers municipal projects and anything else. It’s important to remember again that those in rural areas don’t pay for all the services that those in the urban area do.

Print This Post

Print This Post