Property tax increase for Quinte West

By Vanessa Stark and Sabrina MacDonald

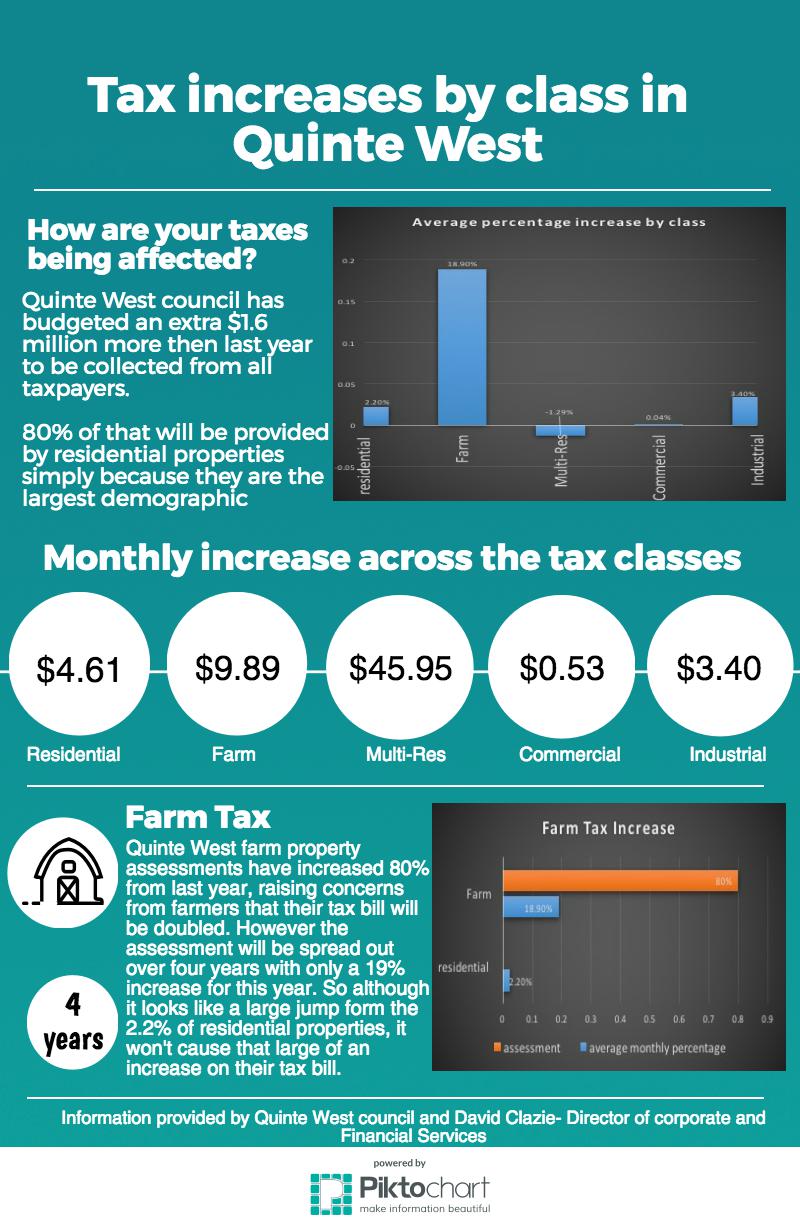

TRENTON – Property taxes in Quinte West will increase by 2.2 per cent or roughly $4.6 a month.

That increase came after a discussion on tax ratios in Quinte West. Council approved a decrease in the multi-residential tax ratio from 2.13 to 2. The tax ratio identifies how much tax all classes, such as commercial, farm, or industrial, pay in regards to residential property which is always set at 1.

In Quinte West the multi-residential property ratio was set at 2.13, meaning that owners of those properties were paying more then double the amount of taxes than other residential properties.

However, last fall, the province set out a regulation stating that if your multi-residential ratio was more then 2, the municipality would not be allowed to collect more taxes from them than they did last year.

“We proposed an additional $1.6 million in taxes from everyone across the city. If we didn’t reduce the ratio, none of the $1.6 million could be collected from the multi-residential class,” said Dave Clazie, director of corporate and financial services for Quinte West.

If the ratio for multi-residential properties stayed the same, other classes would have to make up the difference. By reducing the ratio it makes it more fair for all taxpayers in the community said Clazie.

Claize also said that the $1.6 million will be going to offset any increase in expenses that the city had over the last year.

By Vanessa Stark

Print This Post

Print This Post